Parliamentary Secretary for Youth, Research and Innovation Keith Azzopardi Tanti launched the Post-Doctoral Fellowship Scheme, a national programme that continues to strengthen the careers of researchers after their doctoral studies and that builds a stronger bridge between the academic world and the economic sector.

This scheme, first launched in 2022, is once again being relaunched for the third time as part of the Government’s commitment to build a research ecosystem based on excellence, impact and opportunity.

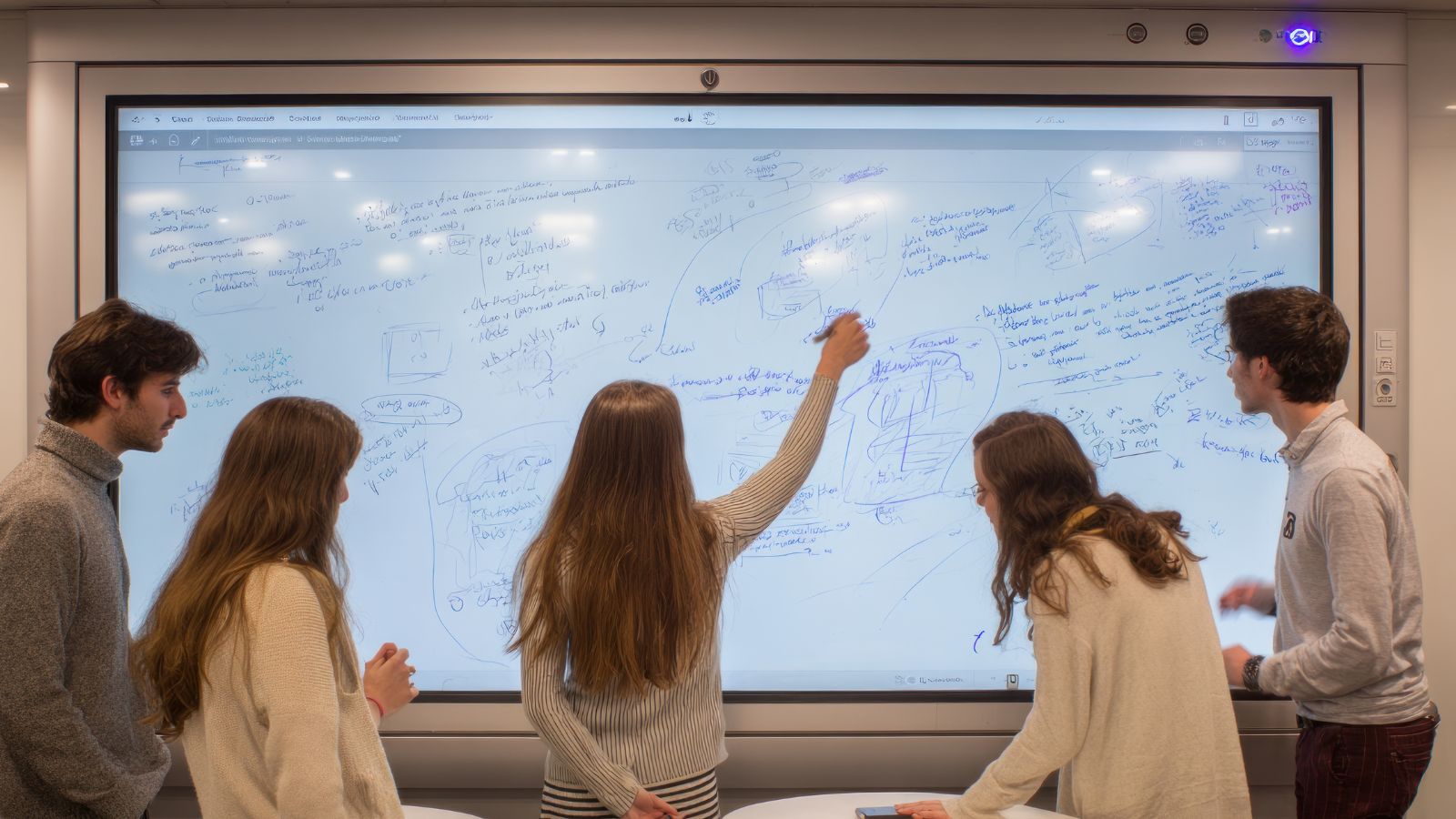

In his address, Parliamentary Secretary Keith Azzopardi Tanti explained how this initiative directly responds to global trends in which an increasing number of researchers are continuing their projects through partnerships with enterprises. “Research is a career, and we must create structures that strengthen it. Through this scheme we are offering practical experiences within Maltese industry and preparing a generation of researchers who not only think but create real solutions. This is a direct investment in a Malta that believes in its young people and opens the doors of opportunity to all.”

The Parliamentary Secretary added that the scheme complements the priorities of Budget 2026, which places strong value on advanced education, innovation, and the development of specialised careers. He stressed that the scheme is a clear Government commitment to continue investing in knowledge, excellence, and economic resilience.

Mark Bajada, The Malta Chamber Vice President, highlighted that “at The Malta Chamber, we have always believed that innovation is the engine of sustainable economic progress. It turns research into solutions, ideas into businesses, and vision into competitiveness. Innovation is not an abstract concept, it is the application of knowledge that improves how we live and work.”

He noted that the Post-Doctoral Fellowship Scheme exemplifies this belief. “By linking the University of Malta’s research excellence with the creative and entrepreneurial energy of our economic players, this initiative offers a platform where ideas are tested, refined, and scaled into real-world outcomes. It moves Malta closer to its goal of becoming a knowledge-based economy built on trust, collaboration, and shared value,” he added.

For his part, the Rector of the University of Malta, Professor Alfred J. Vella, praised this scheme and recognised its crucial role in strengthening Malta’s research ecosystem. “At the University we continue to invest continuously in our students and researchers. Research is, and will remain, a primary priority for the University—it is through research that we create new knowledge, address national and global challenges, and prepare the next generation of thinkers and innovators. Last March, 77 individuals graduated with a research doctorate, all eligible for this scheme. I look forward to seeing it lead to new opportunities that strengthen both the academic careers of our researchers and Malta’s wider research ecosystem.”

The Rector also emphasised that the growing demand for advanced research opportunities calls for more programmes of this kind, which can boost the University’s competitiveness and reinforce its role at European level.

The scheme, delivered through full collaboration between the Ministry for Education, Sport, Youth, Research and Innovation, the University of Malta and The Malta Chamber of Commerce, Enterprise and Industry will continue empowering local researchers to create innovative solutions with national impact.

Through this scheme, Malta continues to strengthen itself strategically as a centre for advanced research and innovation, sending a clear message that investment in knowledge is an investment in the country’s economic and social future.