Bank of Valletta (BOV) and the University of Malta (UM) have entered into a strategic five-year agreement aimed at strengthening collaboration on joint research initiatives and providing new career opportunities for students. This partnership represents a significant investment in Malta’s future workforce, linking academic potential with real-world work experience in a fast-changing financial landscape.

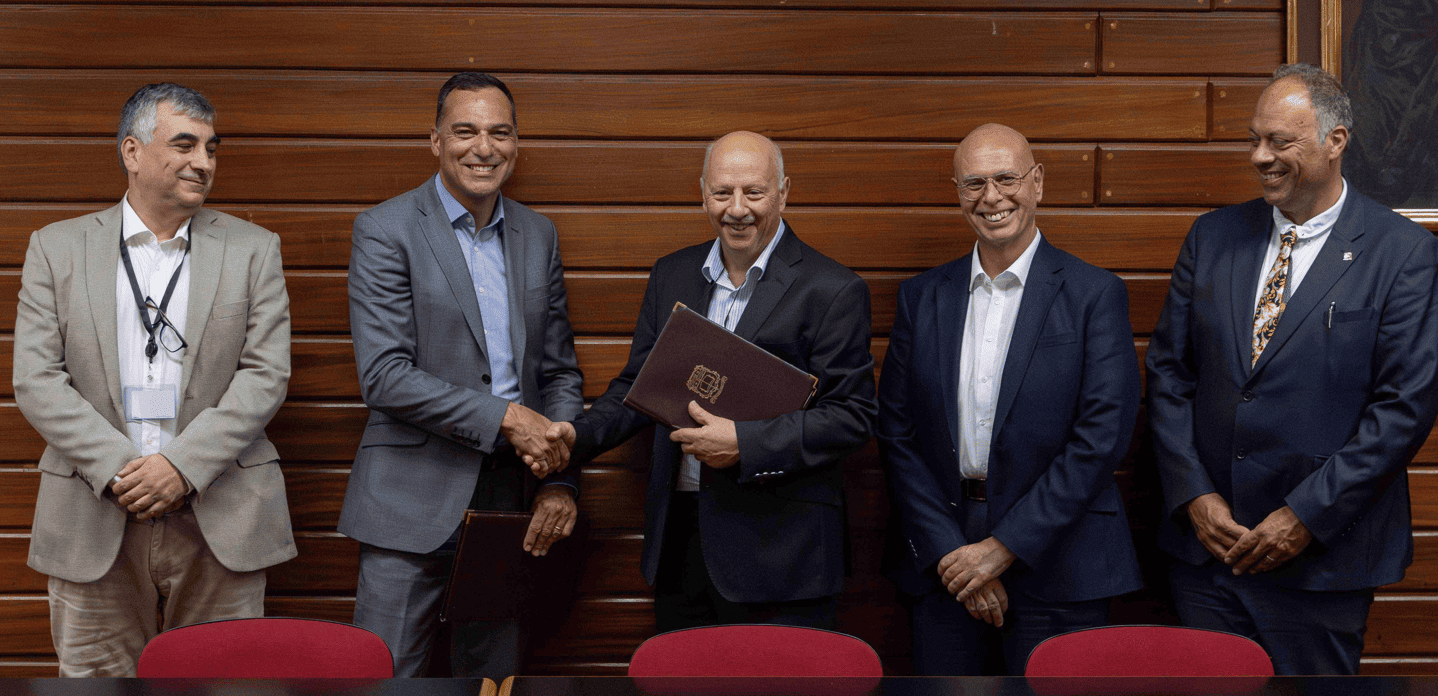

The Memorandum of Understanding was signed by Professor Alfred J. Vella, Rector of the University of Malta, the Dean of FEMA, Prof. Emanuel Said, the Dean of the Faculty of ICT, Prof. Ing. Carl James Debono, and Ray Debattista, BOV’s Chief People and Culture Officer, in the presence of Antoine Aquilina, Chief Information Security Officer at the Bank.

This agreement brings together Malta’s longest-standing academic institution and Malta’s leading financial services provider, creating new opportunities at the intersection of education and industry. The University of Malta, with over 400 years of academic excellence, continues to drive innovation through its forward-looking faculties. Bank of Valletta, on its part as Malta’s Bank of Choice is evolving in step with the financial world, offering a wide range of specialist areas of employment from risk management, cybersecurity, and digital transformation to sustainability finance, customer experience, and data science.

Speaking at the signing, Professor Alfred J. Vella, Rector of the UM, said, “This agreement strengthens our ties with one of Malta’s most prominent financial institutions. We believe in bringing together academic knowledge and real-world experience, and this partnership provides a platform for students to view firsthand the demands and opportunities of the evolving financial sector.”

Ray Debattista added, “We’re proud to collaborate with the University of Malta to attract and develop the next generation of talent. This agreement highlights BOV’s commitment to nurturing local talent and reflects our belief in long-term investment in people, adding value not only to the Bank but to the wider student community, cementing its role as a future-focused, inclusive employer of choice.”

The Faculty of Economics, Management and Accountancy and the Faculty of Information and Communication Technology at UM will lead the academic engagement in collaboration with BOV’s Risk Management function.