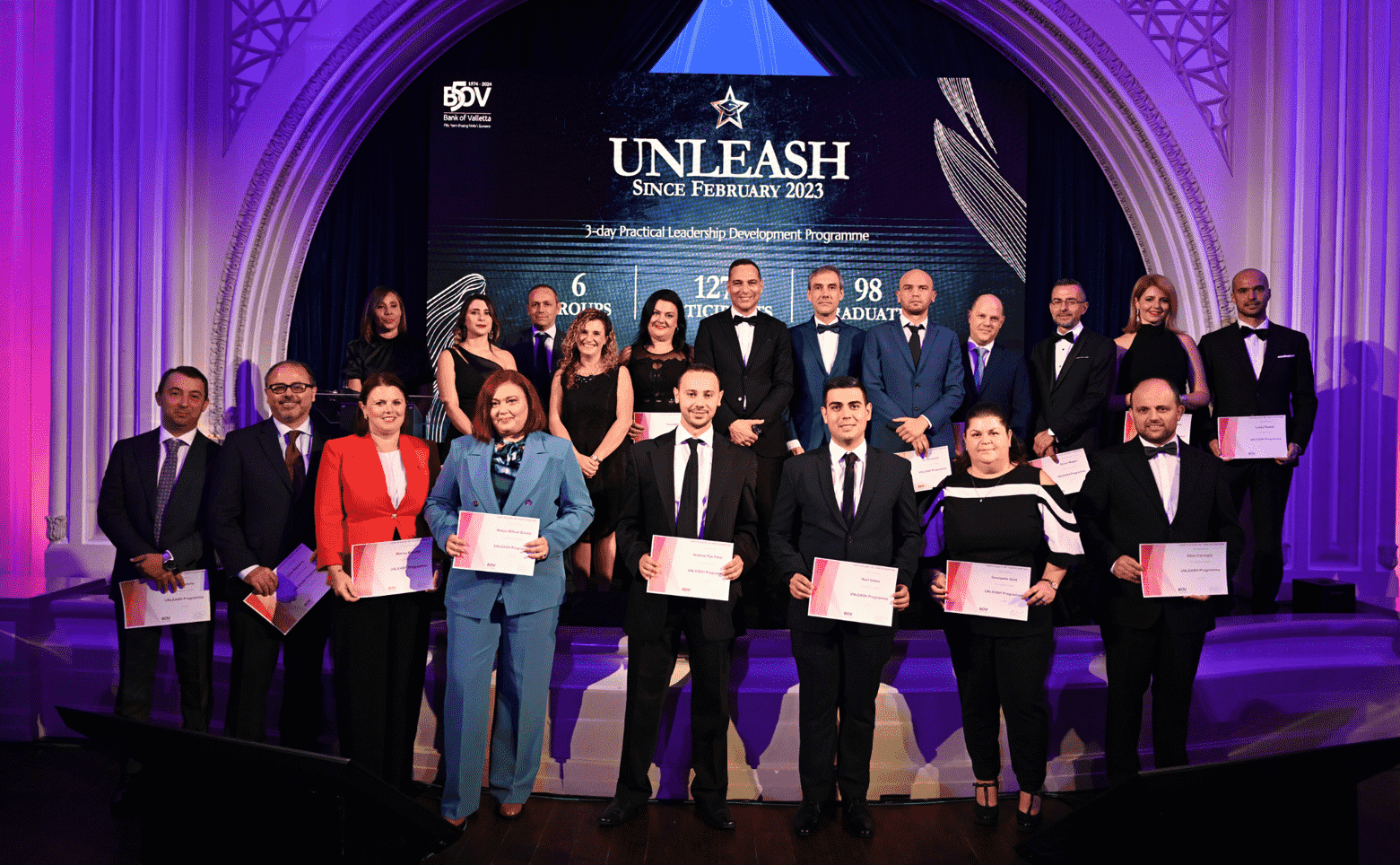

The 2024 edition of the L-Istrina BOV Piggy Bank Campaign, officially launched in late October by H.E. Myriam Spiteri Debono, President of Malta, and Bank of Valletta CEO Kenneth Farrugia, has now entered its final stage. To mark this stage, the President of Malta visited the volunteers who are meticulously counting the generous contributions collected from children across Malta and Gozo. The President was welcomed at BOV Centre on Monday afternoon by the Bank’s Chairman Dr Gordon Cordina, CEO Kenneth Farrugia and Chief Operations Officer Ernest Agius.

This year’s campaign introduced a significant step towards sustainability by using reusable piggy banks, ensuring a reduction in waste and promoting environmental awareness. This initiative aligns with Bank of Valletta’s commitment to Environmental, Social, and Governance (ESG) principles.

CEO Kenneth Farrugia highlighted the campaign’s legacy, stating:

“For 21 consecutive years, Bank of Valletta and the Malta Community Chest Fund have joined forces for the L-Istrina BOV Piggy Bank Campaign. Over this time, funds raised by schoolchildren, along with the Bank’s contributions, have surpassed €3 million. This campaign reflects our commitment not only to financially support the Foundation but also to fostering values of altruism, solidarity and care among the younger generation. These funds play a pivotal role in helping the MCCF improve the lives of those in need.”

Ernest Agius, Chief Operations Officer (COO) remarked on the campaign’s logistical and environmental improvements. “This year, the introduction of reusable piggy banks exemplifies our ongoing efforts to merge community support with sustainability. By involving students from all primary and secondary schools, we’re embedding environmental responsibility while sustaining the core mission of solidarity and giving,” he said.

During her visit to the BOV Centre on 17th December to meet the volunteers, H.E. Myriam Spiteri Debono emphasised the campaign’s broader impact, noting, “Beyond raising essential funds, this initiative nurtures generosity and altruism in children. It is a testament to how a simple act of giving can build stronger communities and instil lifelong values.”

As the campaign continues to evolve under the tenure of successive Presidents, it remains steadfast in its purpose to engage young minds in creating a better sense of community and well-being.

The funds collected through the campaign, along with a significant donation from Bank of Valletta, will be presented during the live broadcast of L-Istrina on 26th December 2024, contributing to the Malta Community Chest Fund’s mission of providing quality care for those in need.