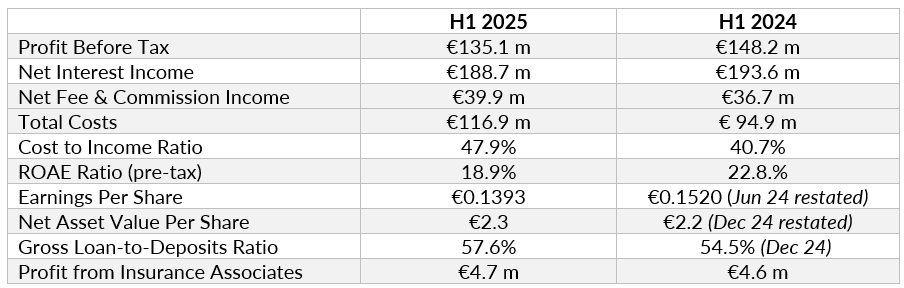

Bank of Valletta today announced a positive, sustained financial performance for the first half of 2025, declaring a profit before tax for the BOV Group of €135.1 million. This result reflects the Group’s continued resilience and strategic progress, laying a strong foundation for further growth and innovation in the months ahead.

The Bank also declared an interim gross dividend of €55 million (€0.0856 gross/€0.0556 net per share) to be paid to shareholders from the Group’s six-month profits, reflecting a 39.9% payout ratio of Profit After Tax. The Bank has also set aside €7.8 million as a share buyback reserve, as approved by the latest AGM and by the regulator.

The Group has seen noticeable growth from key business areas, including credit, investments, and fee and commission income. Expectations for the current financial year continue to trend towards a profit before tax between €215 million and €250 million, with dividend distributions set around a maximum of 50% of profits.

Financial Highlights

As expected, the first half of 2025 saw a decline in profit before tax of 8.8% when compared to the previous year, aligning with forward looking guidance provided at the end of FY2024 and driven mainly by a lower interest rate environment and the Bank’s increased investment in technology and people.

Total operating income reached €244 million in June 2025, marking a solid increase of 4.6% compared to the same period in 2024. Net Interest Income remained the primary driving force for the Group. The overall decline in interest rates announced by the ECB was partially cushioned by an increase in interest income generated from proprietary investments (reflecting the strategic balance sheet repositioning carried out by the Bank since 2022), and also by a sustained growth in the credit portfolio. On the other hand, Net Fee and Commission Income continues to play a vital role in the Bank’s income streams, contributing to well-diversified revenue flows that continue to support the Group’s operating profitability.

The Group’s total assets continued to expand, reaching €15.9 billion. The optimisation of the balance sheet continued, with cash and short-term funds declining by a further €79.7 million and the treasury portfolio increasing to reach a balance sheet position of €6.7 billion. The credit portfolio increased by 7.9% to €7.4 billion, and customer deposits saw a continuous growth with the closing balance as at end of June of €13.1 billion. The Group’s capital and liquidity ratios remained strong and above regulatory requirements.

“Delivering a strong performance in line with expectations” – Chairperson Dr Gordon Cordina

Commenting during the announcement, BOV Chairperson Dr Cordina stated, “I am pleased to announce yet another strong performance by the BOV Group for the first half of 2025. Despite the challenges arising from the reduction of interest rates by the European Central Bank and the stresses posed by ongoing global political developments, the Bank continues to deliver positive results.

Our core business remains particularly robust, and our strategy to optimise our balance sheet position, by redeploying cash into longer-term interest-bearing instruments, continues to bear fruit, as do our efforts to generate additional income from other areas of business.

Our efforts to sustain this positive performance during the past eighteen months continue to strengthen our position in the local market. Of note is the overwhelming response to the Bond issue, which led to an oversubscription within mere days of the offer, signifying the confidence that investors continue to place in this Bank. Near the end of June, a bonus issue of 1 share for every 10 shares held was also executed. These initiatives reflect strong earnings and prudent capital management and underscore the Group’s ongoing commitment to delivering value to its shareholders. Positive market response was also noted in the upward trend in share price, witnessed since the end of 2024. This continues to strengthen our resolve and gives us the necessary assurance to follow through with our strategic initiatives.

Over the coming months we look forward to seeing in motion the Share Buyback Program, giving even more value to our trusted shareholders. We will also sustain our effort in supporting the local economy and the sustainability of competitive business in Malta. As we look ahead to the second half of the year, we remain focused on delivering value, driving innovation, and building a more sustainable future.”

“An exciting era for BOV awaits” – BOV CEO Kenneth Farrugia

CEO Kenneth Farrugia also commented on the positive financial performance registered by the BOV Group and highlighted the Group’s remarkable resilience, agility, and ability to capitalise on evolving market conditions and execute its strategy. “Notwithstanding four consecutive reductions in interest rates and a more subdued interest rate environment, our profitability remains not only resilient but also competitive when compared to the record-setting performance witnessed in 2024.

Our credit business remains strong, and we are achieving record net fee and commission income. These outcomes reflect key strategic initiatives, including expanding our personal customer service model, renovating branches, extending service hours, upgrading ATMs, and launching digital improvements. We are also on track to enhance our business customer service proposition by year-end.

Our digital strategy is being executed through several projects that are supporting our transformation ambitions. At the same time, we continue to strengthen our risk management control frameworks, invest in cybersecurity for operational resilience, and uphold strict Anti-Money Laundering and Anti-Financial Crime standards. We also remain committed to ESG goals, and to community initiatives via the BOV Foundation and our CSR program.

Looking ahead, an exciting era for BOV awaits, as we look to diversify our business model and offer general insurance solutions, while continuing to grow our market share in the Second and Third Pillar Pension Schemes.

While 2024 set an exceptionally high benchmark in profits, income and cost optimisation, our current trajectory affirms the solid foundations and prudent risk management underpinning our progress so far. The momentum in our core business remains strong, and our continued expansion and prudent stewardship will ensure that the Group remains well positioned for the future.”

...

...

...

...