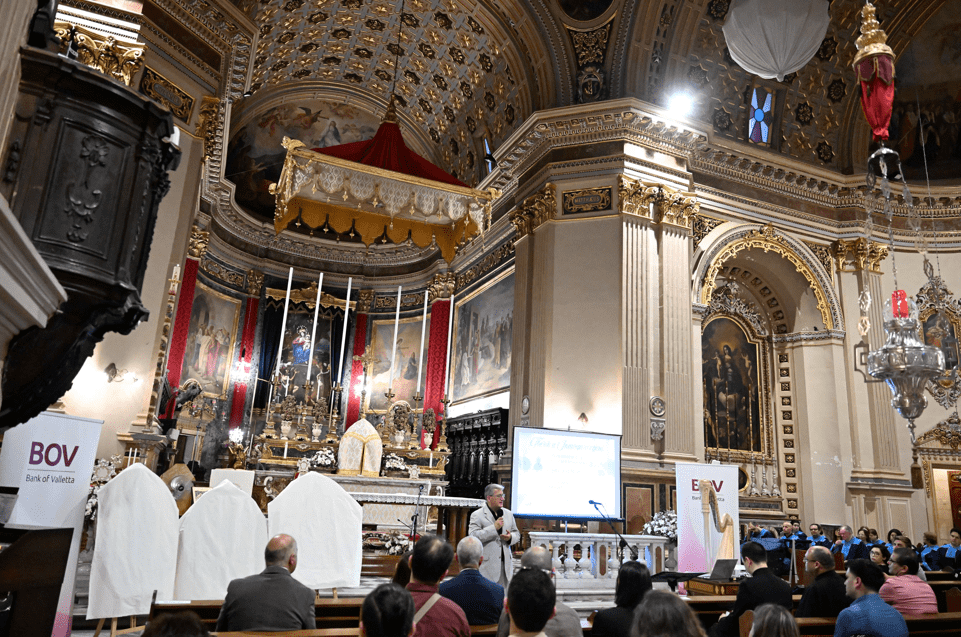

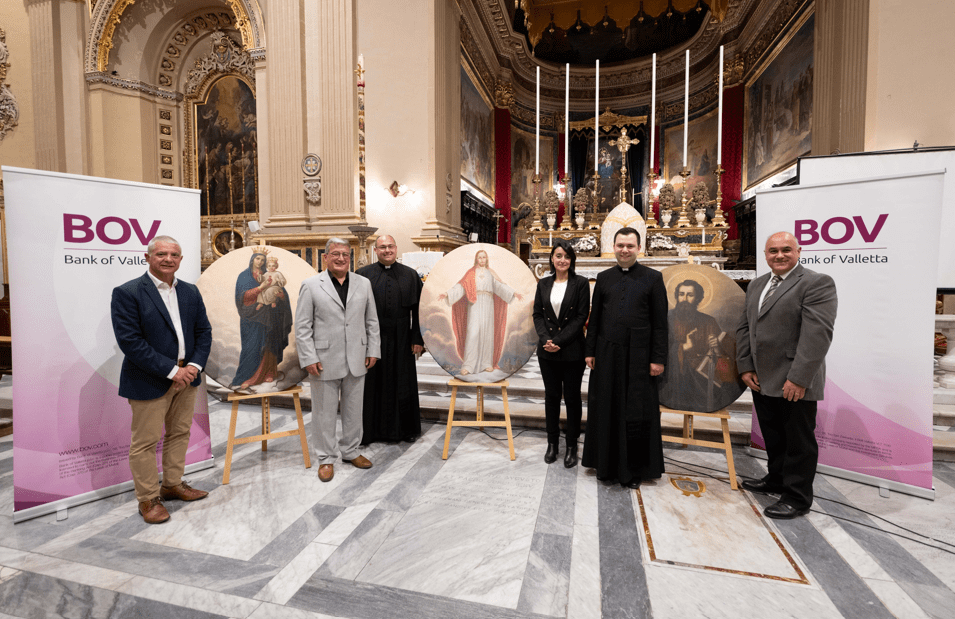

Bank of Valletta has just opened a new branch in Mosta. Situated just a few meters away from its prior location, the new branch at 31-33 Constitution Street symbolises the Bank’s commitment to improving the customer experience and upgrading the service it offers throughout its branch network across Malta and Gozo. An inauguration ceremony was held to commemorate this occasion, presided over by BOV Chairperson, Dr Gordon Cordina, and the Bank’s CEO, Kenneth Farrugia.

The branch features full cash service facilities, a 24-hour lobby, and two ATMs, including a bulk-deposit ATM aimed at business clients. This five-storey branch includes soundproof meeting rooms to ensure client confidentiality, which remains one of BOV’s top priorities, as well as an archives and services area in the basement. It also incorporates sustainable features, such as the use of second-class water and intelligent lighting. Structural works, which took one year to complete, were carried out to enhance the building’s safety and accessibility.

The new branch is the tenth BOV branch to showcase the contemporary and modern aesthetic that defines the Bank’s Branch Renovation Programme. It has been designed with a strong emphasis on customer experience, carefully planned to foster a welcoming atmosphere, promoting both functionality and comfort.

During the inauguration, the Bank’s CEO, Kenneth Farrugia, stated that, “The new branch exemplifies our commitment to environmental, social, and governance (ESG) principles, and at the same time provides an enhanced and more personalised service experience to our customers. With 32 branches and 94 ATMs across Malta and Gozo, BOV remains the most physically present bank in Malta, reflecting our promise to keep the customer at the centre of everything we do. In parallel, we are currently taking forward a project that will see the Bank launch a new internet and mobile banking channel by the end of this year, which will provide our customers with a significantly enhanced suite of functionalities.

Together with our commitment towards customers, we are equally committed to providing our staff with the best possible work environment. We are making a significant investment in our people, and our modernised premises reflect this commitment towards staff well-being, creating a space that our branch staff can take pride in.”

Dr Gordon Cordina, Chairperson of BOV, said, “The community remains an important stakeholder of the Bank. We have always been closely connected with the wider community, and since our founding, we have played a significant role in the lives of most people in Malta. As one of the main pillars of the economy and society at large, we work hard to make a difference by empowering personal and business customers and supporting their sustainable growth. This new branch in the heart of the community will serve as an important centre-point for this growth.”

Present at the inauguration were Chief Personal and Wealth Officer Simon Azzopardi, Chief Operations Officer Ernest Agius and Branch Manager Claudia Chetcuti and her team.