The Vilhena High Yield Fund has continued to attract investor interest, reporting an annualised income yield of 6.25% as of 30th June 2025. Launched in 2006, the Fund now holds over €100 million in assets, with growth exceeding €25 million in the past five years.

The Fund is designed to provide investors with a diversified and carefully selected portfolio, consisting mainly of sub-investment grade and unrated corporate bonds. Available in Euro and US dollar share classes, it is aimed at investors prepared to accept a higher level of risk in exchange for the potential of higher returns, both through income and capital appreciation.

The Fund deals daily and distributes income quarterly (30 April, 31 July, 31 October, and 31 January). The minimum initial investment is €2,000 or US$2,000, with a monthly investment plan starting at €50 or US$50, and an initial charge of up to 3.5%.

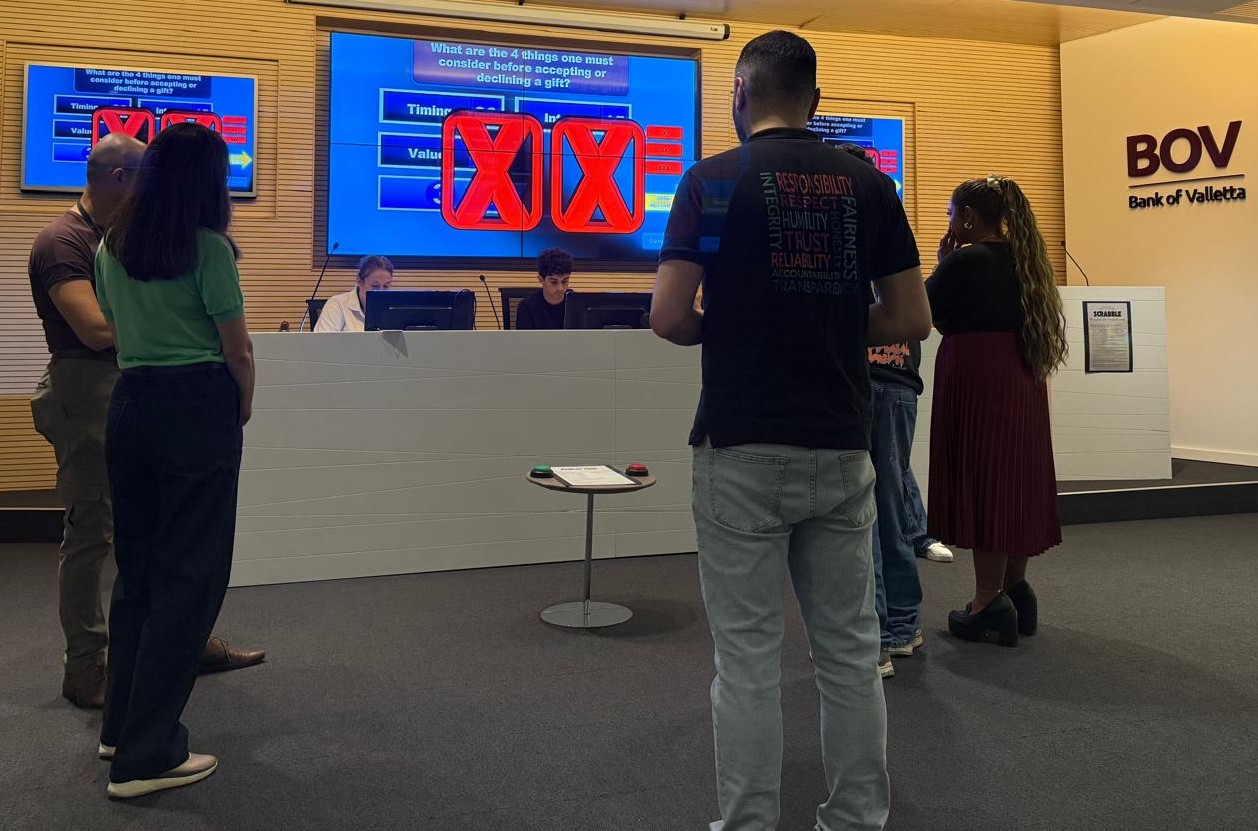

As part of the ongoing High Yield Fund campaign, running until 30 September 2025, Uli Gerhard, Senior Portfolio Manager at Insight Investments Management (Global) Limited, the sub-investment management company of the Fund, delivered an expert session on the European corporate credit market to BOV employees working within the front-line. He noted that credit fundamentals remain solid, default rates are low, and around 65% of the high yield market is rated BB. Gerhard emphasised that performance in high yield is primarily driven by detailed bottom-up credit selection, with the Fund’s portfolio built around approximately 100 carefully chosen companies.

Uli Gerhard explained, “The high yield market remains well-balanced, with attractive opportunities for income and potential capital gains. The focus remains on companies with stable cash flow and predictable business models, ensuring a disciplined approach to risk.”

Peter Paul Cilia, Head of BOV Asset Management Limited, the investment manager of the Fund, added: “The Fund continues to provide an alternative to traditional deposits for investors seeking long-term financial growth. Its diversified portfolio and active management approach are key to its steady performance.”

Further information, including the Prospectus, Fund’s Offering Supplements, and Key Information Document, can be obtained from BOV Asset Management Limited, BOV branches and Investment Centres, or licensed financial intermediaries. Details are also available here.

...

...

...

...

...

...