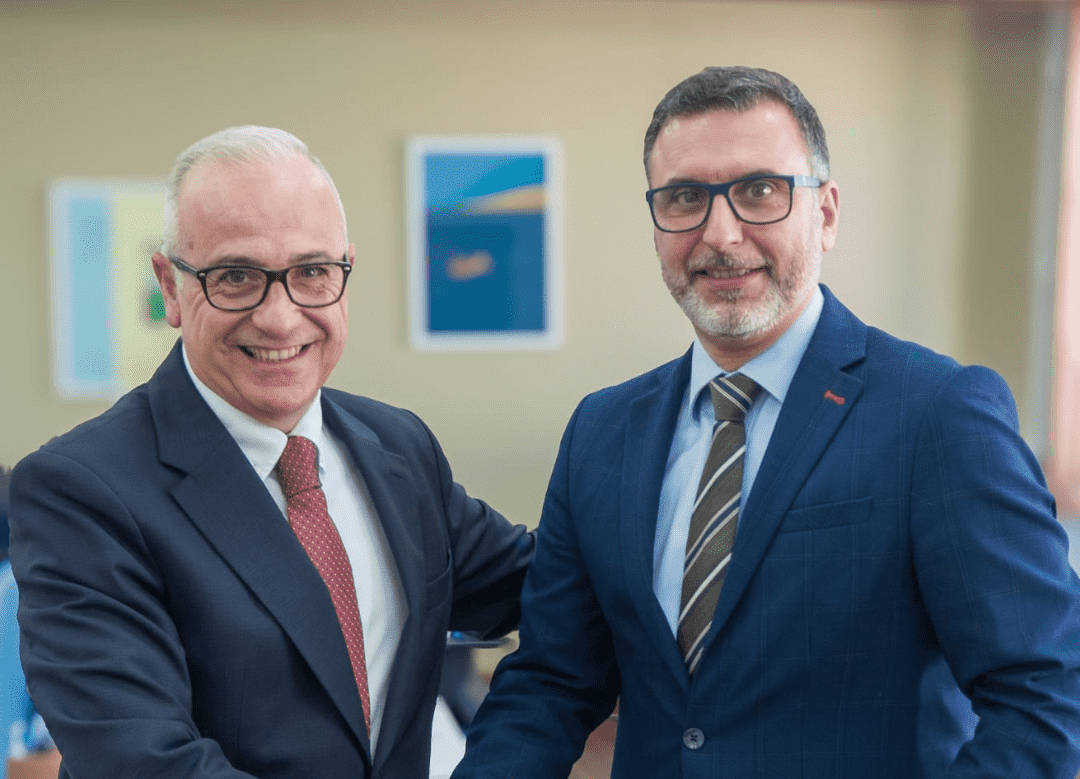

MBB thanks outgoing CEO Joe Tanti for 15 years of sterling service

Mario Xuereb has been appointed as the new Chief Executive Officer of the Malta Business Bureau. Founded in 1996, the MBB is the EU business advisory organisation of The Malta Chamber of Commerce, Enterprise and Industry, and the Malta Hotels and Restaurants Association.

Mr. Xuereb is a respected professional in journalism, media, and broadcasting circles. Until recently, he held the position of Assistant Editor at the Times of Malta. Before this role, he spent 12 years with Public Broadcasting Services, serving as Senior Manager, where he successfully oversaw several documentary and audio-visual projects broadcast on TVM. Earlier in his career, Mr Xuereb served as Head of News at Media.Link Communications until 2009.

In addition to his professional accomplishments, Mr Xuereb is a visiting lecturer at the Department of Policy, Politics & Governance within the Faculty of Economics, Management and Accountancy (FEMA) and at the Institute of Maltese Studies at the University of Malta.

Currently, he is pursuing original research for his doctoral studies. His academic qualifications include a Bachelor of Arts (Hons) in History, a Postgraduate Certificate in Education, and a European Master’s degree in Mediterranean Historical Studies.

Mr Xuereb’s expertise extends beyond Malta, having collaborated on audio-visual productions with Radio Rai, the Comunità Radiotelevisiva Italiana, and TRT.

On his appointment Mr. Xuereb commented about his eagerness to lead a multi-talented team of professionals and executives in advocating for and lobbying on behalf of Malta’s business community.

“I am thrilled to begin this role as CEO of the MBB, at the helm of an organisation composed of a small yet highly capable group of professionals and executives who have dedicated years of work to supporting Malta’s business sector.

“Throughout my career, I have had the opportunity to observe and report on the evolution of various EU directives, regulations, and laws, and their impact on Maltese businesses and enterprises. Now, I have the chance to contribute directly, ensuring that Malta’s unique circumstances receive greater recognition in the shaping of European legislation, particularly within the context of today’s global challenges.

“At the same time, I will ensure that the MBB enhances its communication with businesses in Malta, offering them innovative solutions to adapt to ever-changing realities.

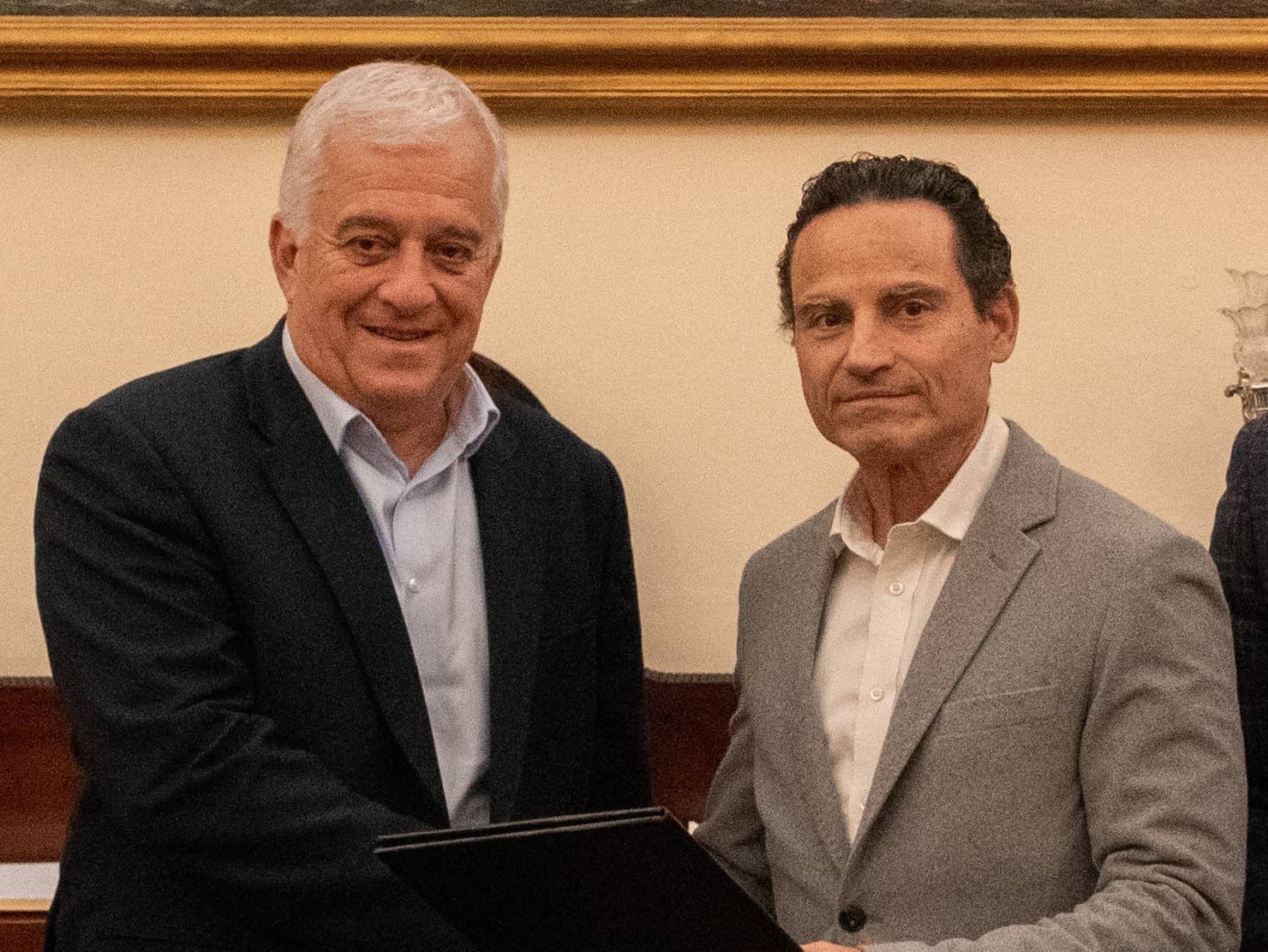

“To achieve this, I will build on the strong foundation laid by Joe Tanti, whose long and dedicated service leaves a lasting legacy.”

The MBB President and Board of Directors thanked outgoing CEO Joe Tanti for his loyalty and long years of service during which the organisation grew in its outreach and services offered to the Maltese business community.

During his tenure Mr Tanti played a pivotal role in MBB’s growth and development. He spearheaded efforts to strengthen the capacity of MBB’s Brussels operations, established the organisation’s EU funding arm, and broadened its business services through the MBB’s partnership with the Enterprise Europe Network. These initiatives firmly positioned MBB as a leading voice for Maltese businesses within the EU.

Reflecting on the organisation’s achievements, Mr Tanti remarked: “It has been a privilege to work closely with and support local entrepreneurs and business leaders over the years, helping to address challenges such as competitiveness, securing access to finance, adopting sustainable business models, driving digital transformation, and more.

“Throughout my time with MBB, I have had the honour of working under the guidance of various Presidents and Directors on the MBB Board, as well as collaborating with the CEOs of The Malta Chamber and MHRA. I was also fortunate to work alongside many talented young professionals whose passion and dedication to the organisation have been a constant source of inspiration. I am proud of what we have achieved together, and with that sense of pride, I am pleased to hand over the reins to Mario Xuereb. I am confident that he will lead MBB to even greater success. There are significant opportunities to expand MBB’s network and communications, and Mr. Xuereb is exceptionally well-prepared to seize them.”